| ORDER A READING FROM A 13 SIGN ASTROLOGER |

| Your Monthly Horoscope | Contents | Subscribe |

|---|

Wizard of $0

Photo by Andrew Harrer/Bloomberg via Getty Images

Janet Yellen, the head of the Fed, has pounced. But don't worry, it's not going to hurt, she has no claws, no teeth, she's a scardy-cat that shrinks in the corner and works for a bowl of kibble. All she wants is to please her tiger-taming masters. She responds to the snap of the whip.

She raised interest rates a fraction of one percent. If she wasn't such a cowardly Leo (see her chart below) she would have raised them to 20%. This pathetic swipe of her declawed paw won't even pay the cleaning bill. Yellen has continued the assault on the traditional scrooge type of leadership in the Fed. The mandated role of the Fed is to curtail the presidents and politicians when they want to provide cheap money to their constituents. The Fed, defender of the dollar, the world's reserve currency, wants as few of them in circulation as possible. When Nixon needed money, he took dollars off the gold standard, screwing its creditors, but the Fed raised interest rates 17%, and forced a wage and price freeze to restore stability of the dollar.

Kennedy also tried to take over the Fed, but it wasn't until the Reagan-Greenspan era that cheap money and inflation became the basis for the biggest bubble in US history.

The era of cheap money continues and the wimpy Yellen regime continues the trend, with Quantitative Easing and zero and even negative interest rates. The politicians and the bankers now agree, there's no stopping the flood of cheap money. Free money for the speculators however, only causes falling wages and unemployment for the workers.

Why the Fed can't raise interest rates.

One of the most pressing problems in the world right now is plunging interest rates. The central banks, led by our Fed, have continuously lowered the interest paid on government bonds (and perforce ALL bonds) to new lows, even zero percent and minus percent interest yields.

Zero percent interest means that if you buy a five-year treasury bond, at the end of five years, you make no profit. In a deflationary economy, whatever value you think you own is really worth less. Why would anyone in their right mind park their money into bonds, when it’s a money-losing proposition? The answer is that other investments are worse. At least the Fed guarantees (?) the principle, the bonds are backed by the US dollar. The only value of the treasury bond lies in the horrible shape of other bonds and currencies.

Low interest rates on US bonds also hurt other bonds and currencies. You can’t make money by saving anymore. You lose money by saving it. So you have to spend it as fast as possible before it is worth even less. That’s what the rich do to keep their heads above water. The Fed actually gives “preferred” banks a MINUS interest rate, so that borrowing money for them realizes a profit for them, as long as they spend it right away in the financial markets, or buy luxury goods. This is why the banks spend Fed money on paper assets, junk bonds, credit swaps, condos, dot-coms, Picassos, jewels, and sports cars. They even make bad investments in the catastrophic fracking and shale oil industries, which will never return a profit, since the falling price of oil is making all fossil fuel investments sub-prime. Who cares? It’s like running to the stern of the Titanic as it sinks head-first into the water. At least you’re the last one to go! It’s better to throw away your money than to give it away.

The Fed, and other central banks around the world, are forcing the banks to throw away money, because they can actually guarantee in writing that things will be worse in the future. The Fed encourages governments and corporations to take on additional debt (that can never be repaid) by issuing new low-interest bonds and common stocks. The central banks will then print new money, give it to investments banks, that buy the worthless stocks and bonds, which provides a windfall of unearned, free cash to the issuer. The debt is ultimately assumed by the government, in the name of the workers and savers of that country. This is why a country like Switzerland can end up owning $160 billion worth of stock in foreign companies. The Swiss central bank owns most of the stock in Facebook, for example. They never asked the Swiss if they wanted to invest in a dubious investment like Facebook, a “unicorn” which can’t make a profit without more investment. They did it by fiat, in the same way they decide to print money without the consent of the workers.

The Central banks are in effect bribing corporations and rich people to hoard their money, like Apple does, or like the banks, which invest in paper assets rather than pumping money into the failing economies of their countries. Banks have no motivation to invest in the productive capacities of their countries. Why should they? There’s no profit in it. There is way too much productive capacity already, world-wide, but by buying into mergers or share buy-backs and other worthless financial frauds, they can get rich overnight, at the expense of wage workers, mutual funds, pension funds and savings accounts.

The other advantage is that the central banks get to keep the debt bubble from popping. By throwing more money into “debt-production” they can keep the GNP looking good, and keep the rich, rich. By buying the worthless bonds at zero or minus-zero interest yield, they can actually remove, or steal, the value of the money from people who save, or work, and transfer it to the pockets of the rich, with a wave of a magic wand. For the central banks and the Fed, it’s a win-win situation.

Everybody wins but the people. And, of course, the dollar. This process is like slow death of the once mighty dollar. The Fed is hollowing out the value of the dollar from the inside, like termites eating the foundation of your house. Why doesn’t the dollar collapse, like a pancake? The dollar’s status as the reserve currency. It is the currency used in 60% of all global transactions—so everybody must prop up the hollow dollar whether they like it or not, in order to maintain the velocity and exchange of money in their own countries. The central banks of other countries are forced to keep the dollar strong by printing more of their currencies to support it. This destroys the social and economic fabric of their own countries. In China, for example, most contracts are written in dollars, so if the dollar were to fall, the value of the contracts would fall. The Chinese must print Yuan to cover the falling value of the dollar, in order to keep their economy from tanking. The dollar is like a gun to the head of other countries who use the dollar.Like real warfare, these currency wars kill the people and make the war profiteers rich. Even as the world economy collapses, the banks and other financial institutions are getting rich over charging “management” fees and siphoning money out of the pipeline as it travels around world markets.

The only way the capitalist can save the system from utter destruction is to raise interest rates—and give banks a profit for legitimate investments and reward people for saving money. But if the central banks raise the interest rates, they will prick the debt bubble, and bring the whole system down to its knees. Raising interest rates would kill the markets, but eventually save capitalism. By LOWERING interest rates, they can keep the bubble pumped up, at the expense of the future of capitalism. It would take great insight, foresight, and political courage to raise interest rates to 20%—the type of increase that would save the world economies. This would pop all the bubbles and drive the banks and the hedge funds into instant bankruptcy, but it would save the system in the long run. It would be like cutting off the gangrene to save the rest of the body. But the Fed will never do this, and instead, continue to lower interest rates to zero, and beyond, to minus 1%. 2%, 3%!

What would happen if Janet Yellen, the head of the Fed, raised interest rates by just 1%? According to the chart below, the world debt bubble is anywhere from $17 trillion to $40 trillion of worthless or overvalued assets. If the Fed raised interest rates by 1%, the world markets would instantly lose at least $1 trillion, possibly more, $2.5 trillion. They would have to sell assets to protect themselves. When the rich all sell assets at once, in a panic, it’s called a crash.

This shock in the markets would drive the financial industry into instant deflation and bankruptcy. The banks would fail, stock and bond holders would lose their shirts—and their power. Homeowners would see the exaggerated value of their homes fall to below normal levels, causing them to default. The true nature of our deflationary economy would be exposed and people would have to live off the wealth that they actually create, through labor, and not using an asset bubble and fraud to make money.

Raising interest rates just 1% could kill the rich and elevate the humble and lowly workers back into a new-found source of wealth and production, which they once were, and always shall be. Raising interest rates would transfer the power from the rich debt owners, back to the poor debt slaves, and cause a revolution.

That’s why the Fed can’t raise interest rates!

What Yellen did was to raise rates the least amount possible, 15 points, to 1/4 of one percent; although even this tiny amount will cause ripples costing the banks billions of dollars in margin calls. The raise wasn't enough to satisfy holders of dollars. Yellen failed everybody; trying to please everyone, she didn't please anyone. Like many women in power who were appointed by men, she is at the helm of a sinking ship, the captain of the Titanic. The male patriarchy's last gasp is to transfer blame to a female patsy. Yellen is a stand in for Goldman-Sachs, the stunt-woman who gets the hits.

Now we know the Fed isn't going to save the dollar, it's a bust-out. This is where the Mafia investors rack up the debt on your business and then burn down the building for the insurance. The banks are organizing a last plunder of the dollar.

The banks are the instigators for free money, but the Obama administration is responsible for the zero percent interests that the markets have enjoyed, in spite of the risks to the greater economy. The Obama foreign policy has been to spend trillions of free dollars on wars with no return except for profits for the war industry. War just makes the case for austerity more urgent, causing more poverty.

The situation is called deflation, where the economy dies on the vine. The economy has to torture itself, tear off its own flesh in order to molt into a new skin. Each nation addresses deflation in its own way. Throughout history, deflation usually leads to war.

Corporations exported goods, then capital, then jobs, now they're exporting war and debt. Currency wars traditionally lead to trade war, and escalation towards real war, and extreme volatility for the financial markets at home. American domination of the world is the main threat to peace. The rest of the world is rising up against US hegemony. The Russians have already checkmated American military efforts in the Ukraine and Syria, and the Chinese are quietly side-stepping the dollar in order to finance its incursion in South East Asia and Africa. If the Chinese were to strike a deal with Iran to buy its oil for a Yuan/ Renminbi-funded currency, it would throw the American economy back into the 19th century.

The Wizard of the Dollar

Fantasies have always been prophetic. When Dorothy and her crew first visit Oz, the wizard really awes them; he blows a lot of hot air, keeping the people of the Emerald City in lock step. When Dorothy pulls the curtains back on the wiz, he's a total fraud. This is what would happen if we could see the true value of the dollar, and the limits of American power for the first time. The powerful wizard, like an emperor with no clothes. is revealed.

The Whiz, exposed!

Mao Zedong said that US imperialism is two tigers, the real tiger and the paper tiger. The American military is a real tiger, but its money is a paper tiger.

You can't unsee what you have seen. The new look at the dollar won't destroy it, just show us what it's worth. There's really no way to end an addiction to cheap money without some pain and discomfort. The banks will be forced to kill their own spawn, the derivative. Wall street will run red with unpayable debt. Only a collective resolve to form new institutions to replace the dinosaurs can save us.

The overall astrological picture is dire. Yellen faces a future of worries for the Fed and the banks, as Mercury and Jupiter go retrograde Jan 8 and then square Venus on the 19th. Mercury slams into Capricorn and gets knocked out cold, having to retreat. This is the classic scenario of a "correction" of the market. Yellen's paltry increase in interest rates may pave the way for the market to implode in order for dollar to find its own value in the chaos of debt and devaluation. Yellen, in effect, surrendered control of the currency to the currency, for a final showdown based on the flame-out scenario. The presence throughout January of of a Grand Trine may only speed up the realization of the downturn, adding to the shock.

When Mercury starts to move into Capricorn, on Feb 15, it has to pay its debts. This margin call will destroy a lot of paper fortunes. The Fed and the banks will have to conform to traditional accounting methods, which would mean an end to the fraud, spoofing, and price-fixing that's been going on for decades. The game is over.

This could also be a time when bankers and hedge fund operators are investigated for fraud. It's a dangerous time if you have something to hide. It's bottom line time. Saturn is in Ophiuchus and the combination can be merciless to fools and liars.

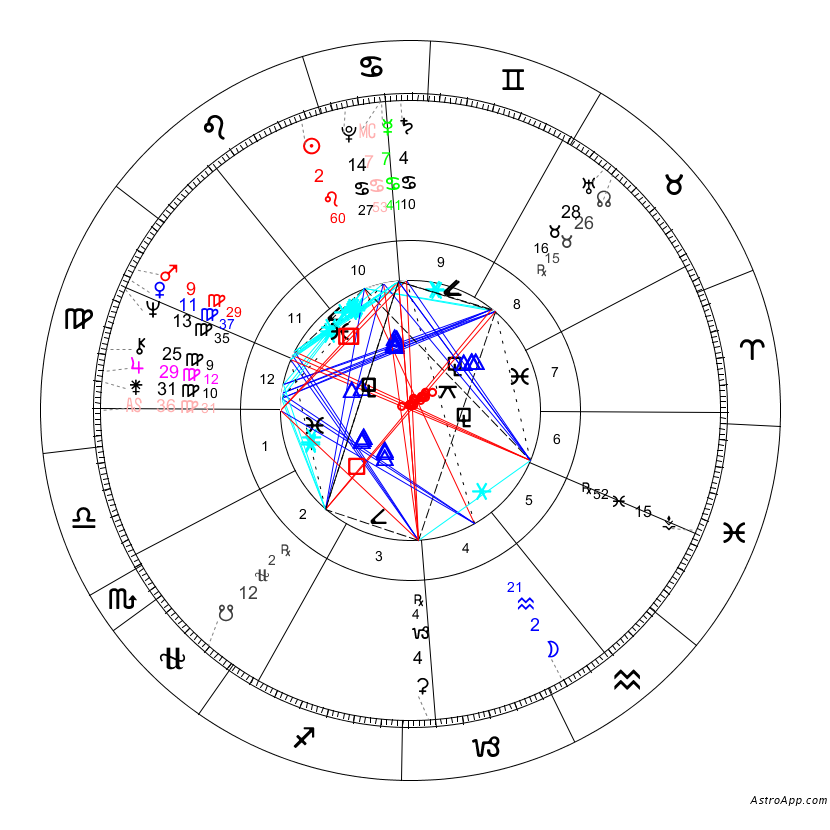

Yellen's Sun is in loyal Leo, but she has no other fire in her chart to take the actions necessary to save herself or the markets.

Janet Yellen's natal chart (time unknown)

Yellen's Moon could be in practical Capricorn, explaining her interest in money and the bottom line, or, if she was born after 8 am, her Moon would be in Aquarius, making her detached from the consequences of her actions (or non-actions). She isn't held to any standards of fiscal due diligence or long term stability. That would also put her Moon in opposition to her Sun. This, as well as her Mercury, Saturn and Pluto in Cancer, would suppress her individuality and ability to address authority. She can imitate authority, but has none, Who is she? Just a figurehead in a white dome of hair pretending to be another Alan Greenspan, with his vague, dissembling Sun in Aquarius matching her rectified Moon. Aquarius-oriented people often can't answer yes-or-no question. Yellen may also have a Yod with her Moon, Mars-Venus and Saturn-Mercury. The turmoil in the markets may make her catatonic, driving her to fly away like an injured bird.

Yellen has never held a job outside academia, and was appointed as a seat-warmer for Jaime Dimon and other Wall Street honchos. She helped to prevent any change in the policies that led to the mortgage bubble of 2008, and her lack of courage to increase rates has been a major point of criticism from many traditional economists, who call her anemic actions now too little too late to save the dollar from a free fall, and too much to preserve profits at present levels.

No one knows how many dollars are in existence. They've been leveraged so many times it's like a Gordian knot of Mafia accounting. Yellen and the Fed has been making dollars look like cotton candy, but the truth of the dollar is anyone's guess, they're more like rotten tomatoes. The world is losing faith in the dollar but it stays the world currency because of American military destructive power. If the US military would ever falter; a humiliation in Afghanistan, for example, it would be the fatal blow to the dollar, and the developing economies would dance on the grave of American Imperialism.

Yellen's fate and the dollar are entwined, she has tied her fortunes to the short term needs of the banks. The same speculators she intends to protect will come back to crucify her. Yellen is drinking the Kool-aid in order to keep the farce alive for a few more months.

posted Dec 19, 2015

updated Dec 30

Comparison of the Zodiac systems

Sign |

Tropical |

Sidereal |

13/Sign |

|---|---|---|---|

| Aries | Mar 21 - April 20 | April 15 - May 15 | April 19 - May 13 |

| Taurus | April 21 - May 20 | May 16 - June 15 | May 14 - June 19 |

| Gemini | May 21 - June 20 | June 16 - July 15 | June 20 - July 20 |

| Cancer | June 21 - July 21 | July 16 - Aug 15 | July 21 - Aug 9 |

| Leo | July 22 Aug 22 | Aug 16 - Sep 15 | Aug 10 – Sep 15 |

| Virgo | Aug 23 - Sep 22 | Sep 16 - Oct 15 | Sept 16 – Oct 30 |

| Libra | Sep 23 - Oct 22 | Oct 16 - Nov 15 | Oct 31– Nov 22 |

| Scorpio | Oct 23 - Nov 21 | Nov 16 - Dec 15 | Nov 23 – Nov 29 |

| Ophiuchus | NA | NA | Nov 30 – Dec 17 |

| Sagittarius | Nov 22 - Dec 21 | Dec 16 - Jan 14 | Dec 18– Jan 18 |

| Capricorn | Dec 22 - Jan 20 | Jan 15 - Feb 14 | Jan 19 – Feb 15 |

| Aquarius | Jan 21 - Feb 19 | Feb 15 - Mar 14 | Feb 16– Mar 11 |

| Pisces | Feb 20 - Mar 20 | Mar 15 - April 14 | Mar 12 – April 18 |

|

||||

13 sign astrology app ($13 a month)

13 Sign charts and real time transits

$4.99 a month: excellent service

CONTACT The Siderealist

© all rights are inherent